Meet the employee benefits co-operative that refunds unused premiums back to its members.

Request A Quote

We are a buying group of company health insurance. Our customers are member-owners.

As a large co-operative representing 30,000+ Canadians, we band our members together to negotiate with Canada's big carriers and purchase health insurance at super competitive rates.

Learn About Us

As a large co-operative representing 30,000+ Canadians, we band our members to negotiate with Canada's big carriers and purchase health insurance at super competitive rates

Learn About Us

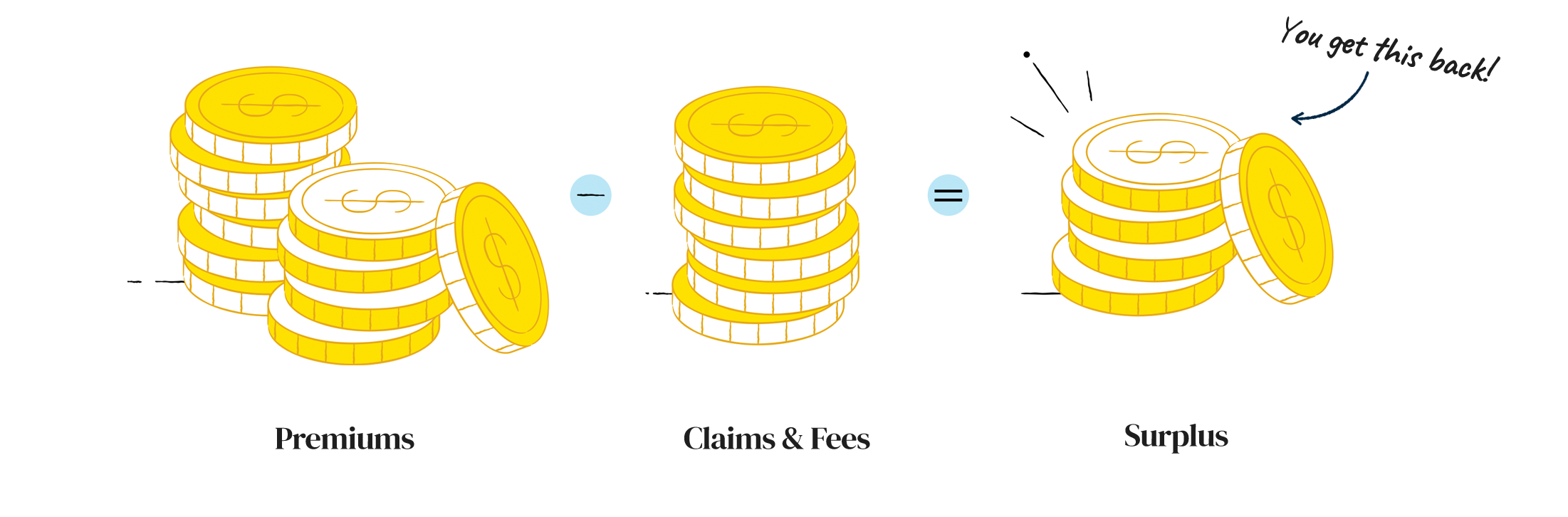

If your claims + fees are lower than your premiums, that money belongs to you, not your insurance company. If by chance your claims are higher than your premiums, the deficit is covered and forgiven by the co-operative.

See How Refunds Work

See How Refunds Work

Josie Perino

As a member of the co-operative, you get free perks and access to services at heavily discounted rates thanks to our large buying power.

Speak with an advisor about how to improve your employee benefits program.

FREQUENTLY ASKED

Beneplan designs, administers and negotiates health insurance plans on behalf of its members that are made up of products that other insurance carriers provide. You can think of us as the "Costco" of group benefits - our members can buy comprehensive group benefits at wholesale rates.

Yes. Beneplan will match the same benefits your employees currently enjoy and can grandfather pooled benefits such as Life and Long Term Disability so no one loses any coverage. We work hard to ensure migration to our plan minimizes disruption and learning curve to the employer team.

There is no catch! At our core, we are a health benefits co-operative that believe that unused premiums belong to the client and not the insurance company.

To learn more about how our refund model works click here.

No. We do not charge any membership fees or dues to our members.

FREQUENTLY ASKED

Our advisors are integral to our success as one of Canada's fastest growing benefits providers. We support and empower like no other.

As one of Canada's fastest-growing benefits providers, we value advisors as an essential part of our business. Join our hand picked group of trusted advisors.

Learn MoreDive into our blog to get fresh insights and news within the health benefits space.

Cost Plus: Use Tax-Free Money to Pay For Unexpected Medical Expenses

The Rise of TeleMedicine & Why It’s Here to Stay